Although the current state of the economy has dampened interest in taking on risky investments, fashion groups and brands like LVMH, Kering, H&M, and Stella McCartney continue to invest in startups providing innovative and sustainable solutions to the fashion industry.

One of the latest projects from Stella McCartney is a $200 million venture capital fund that is dedicated to climate solutions. To support early-stage startups reimagining materials, ingredients, energy, and supply systems, the designer partners with the investment firm Collaborative Fund.

"It is all about sustainable solutions," McCartney said in a video posted on her Instagram. "The goal is to "swap out the conventional, bigger industries with these new, problem-solving sustainable companies."

She's not the only one who recognizes the opportunity. Inditex, the parent company of Zara, made its first "clean tech" investment in July, joining a $30 million fundraising round for Circ, a textile-to-textile recycling company, while Kering, the French luxury giant, invested in lab-grown leather startup VitroLabs Inc in May, followed by investments in luxury pre-owned resale site Vestiaire Collective and handbag subscription service Cocoon last year.

The desire for green technology in fashion reflects much broader social and political changes. Regulators focus on the sector, increasing the pressure on brands to fulfill high-profile promises to reduce environmental effects. Customers also call for change, boosting interest in businesses that promise commercially viable solutions.

Here's Why Fashion E-commerce Giants Should Invest in Small Startups

Last year, venture capital firms made over $1 billion in investments in the retail and distribution industry. That is five times more than what was invested in 2013. After the uncertainty of 2020, this year's fashion innovation ambitions have become more transparent. Since record amounts have been invested in fashion-tech and retail-tech startups over the past 6-12 months, investors are taking notice.

Online marketplaces and platforms have also benefited from the new gold rush: FARFETCH raised $1.15 billion, Lyst $85 million, GOAT Group $195 million, and Vestiaire Collective $210 million. At the same time, Ssense received its first outside funding for an undisclosed sum, resulting in a valuation of over $4 billion.

If you're on the fence about investing in small startups, you may want to consider the following factors:

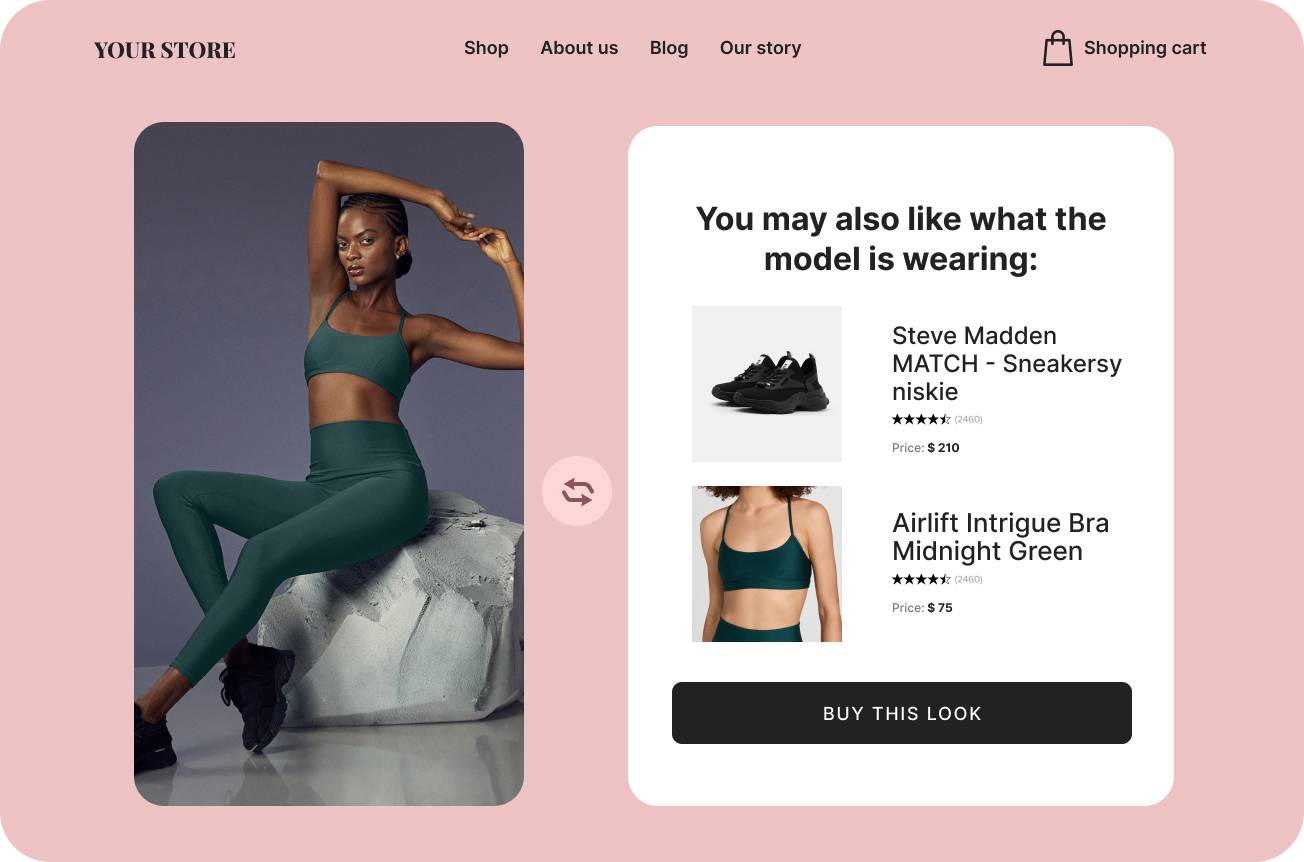

1. Virtual Clienteling

Digital clienteling, text-based shopping, and tech-enabled customer care are all having a moment. Virtual clienteling allows brands to provide a more efficient and personalized shopping experience, leading to increased customer satisfaction and loyalty.

Recent deals and fundraising rounds include:

- Meta purchased Kustomer for $1 billion

- Attentive acquired Tone

- Yalochat raised $15 million

- Quiq acquired Snaps

- Seer raised $2.4 million

- L’Oréal invested in Replika Software

- Neiman Marcus acquired Stylyze

Technology that scales and increases associate capabilities is especially appealing to the luxury market. seer and Stylyze, in particular, both assist with remote product and styling recommendations. "The traditional experience of going into a store to browse is being short-circuited as consumers are getting used to e-commerce-style shopping and returning," says Brad Flora, group partner at startup accelerator Y Combinator — he has worked closely with Seer, which received their Y Combinator graduation this spring. "This hurts traditional brands' and retailers' ability to build brand affinity and get repeat purchases. So, traditional retailers and brands are investing more in digital services that replicate aspects of the in-person shopping experience, which can save them years and millions of dollars of development."

2. Digital Clothing, Blockchain, and The Metaverse

Gaming, digital clothes, blockchain, and other technologies that merge both the digital and physical are gaining much widespread popularity in a broad category. This includes adding digital passports to tangible items and attaching real value to digital commodities. The businesses creating the metaverse envision it as the next generation of the internet. And as with any technology so vast and all-encompassing, the potential is enormous. By 2030, the metaverse could generate between $4 trillion and $5 trillion in value, according to a report from McKinsey.

Overall, the metaverse provides an escape from the real world's issues (such as war, COVID-19, inflation, and inequality). The fact that so many customers are flocking to early-stage metaverses is part of their appeal. CEOs need to ensure they are reaching their clients wherever they are based, virtually and offline. Have a look at some of the recent investments:

- Dapper Labs: $305 million

- OpenSea: $100 million

- Evrythng: $10 million

- Arianee: $9.5 million

- RTFKT: $8 millionBitso: $250 million

- Bitski: $19 million

- Genies: $65 million

- Lolli: $5 million

- DRESSX: $2 million

Although some of these businesses mentioned above aren't just in the fashion industry, they are becoming more and more relevant daily. Virtual spaces and games, like Roblox, which recently went public with an $11.29 billion valuation, are crucial entry points for digital clothing and NFTs. According to Warc data, brand investment in e-sports is expected to increase by 9.9% globally to $844 million this year. "Both Louis Vuitton and Burberry are experimenting through games with NFTs that allow luxury to commoditize and exchange virtual goods, Bibby says. "There is much money in that, and that is why you see Facebook and Snap taking a look at [how to] push tech along to digitize [and exchange] garments."

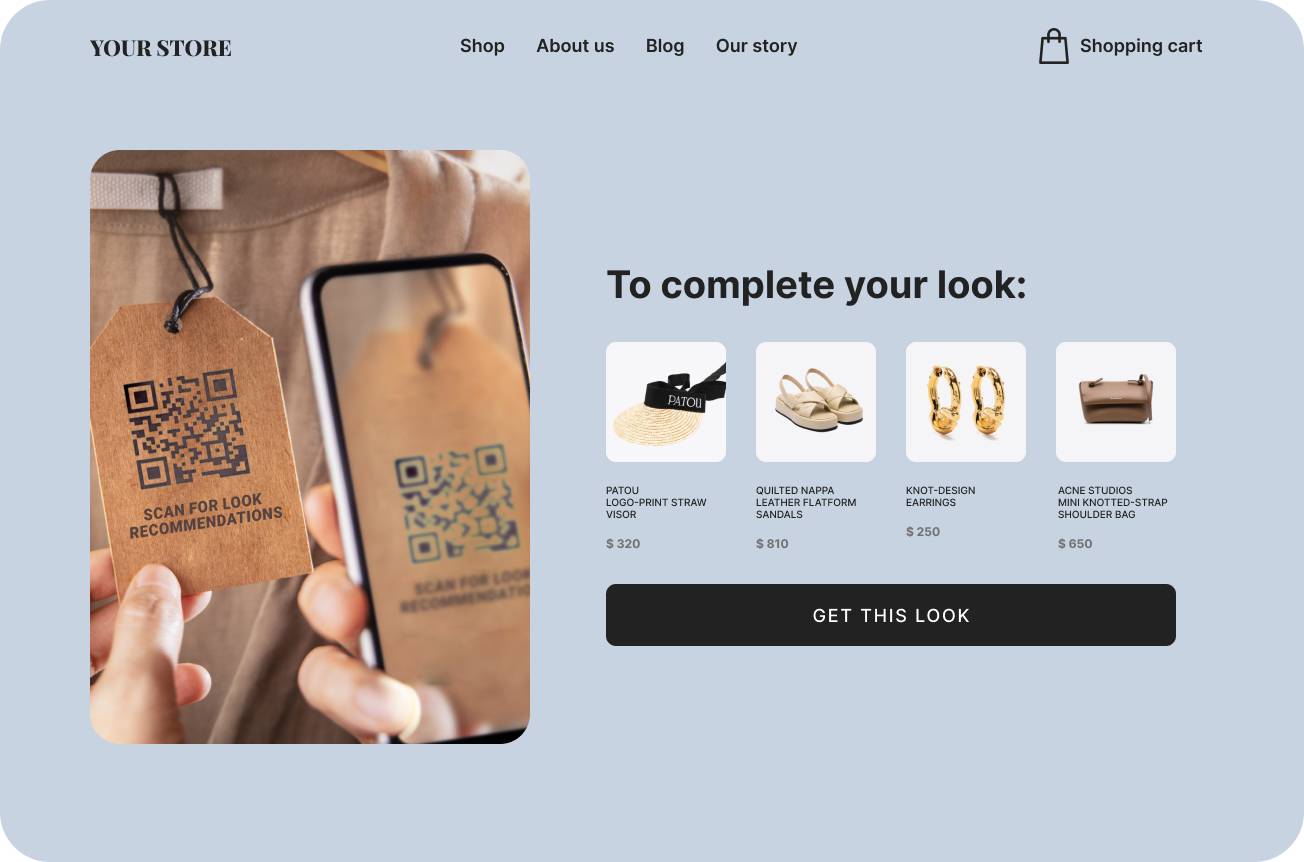

3. Extended Reality

Augmented reality, virtual reality, and mixed reality—closely related to the idea of the metaverse—continue becoming practical marketing tools. They are a crucial area of focus for Apple, Snapchat, and Meta.

Funds raised include:

- Camera IQ: $5 million

- Arcturus Studio: $5 million

- Obsess: $13.4 million

- Snap acquired Vertebrae

Fashion brands may be able to create 3D renders for AR experiences with Vertebrae, a Snap Inc. company. With its purchase, Snap intends to keep its position as the leading platform for AR commerce. The current level of technological knowledge will pave the way for intelligent eyewear. Until that point, Obsess, whose clients include Coach, Tommy Hilfiger, Nars, and Charlotte Tilbury, has been a leader in virtual stores that don't require VR glasses. "We have figured out we can sit in our living room and shop 'til we drop," Withers' Bibby says. "Experiencing something you wouldn't typically experience is a draw for many of these investments."

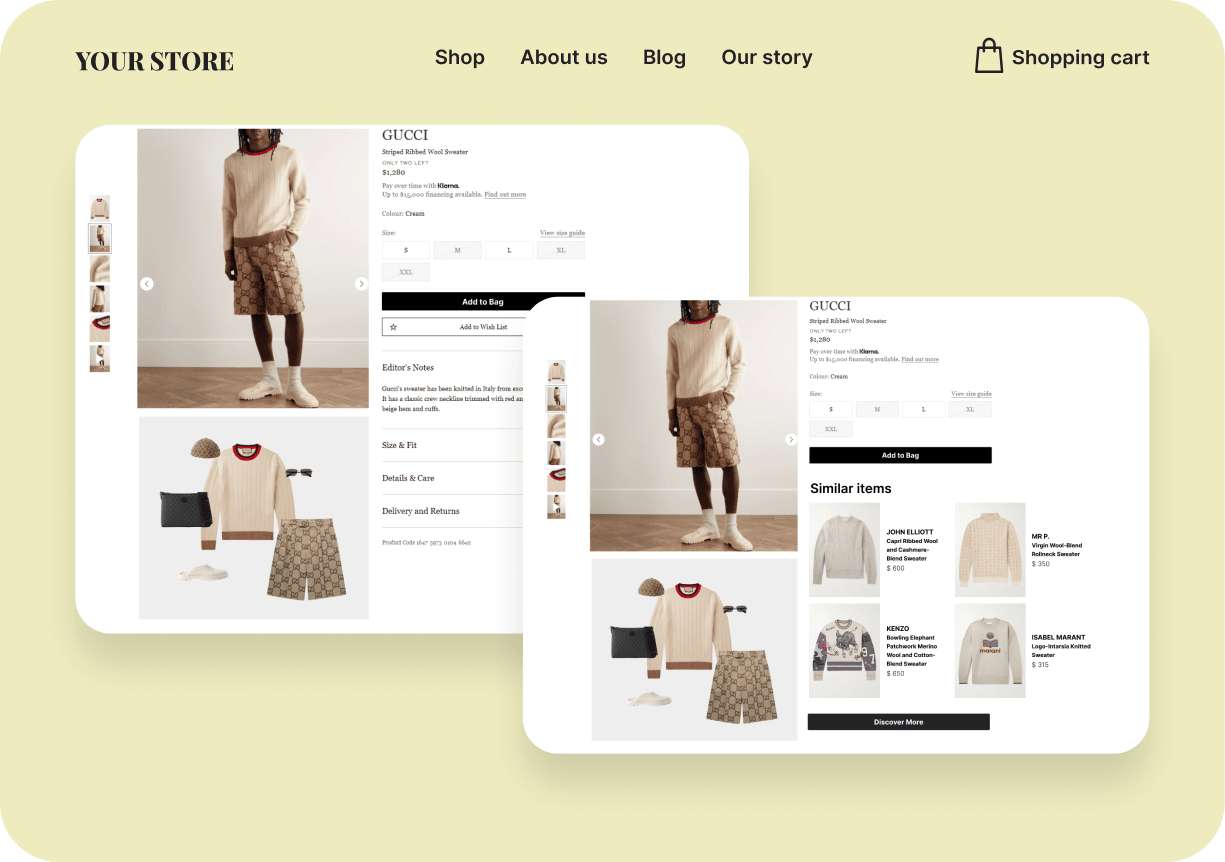

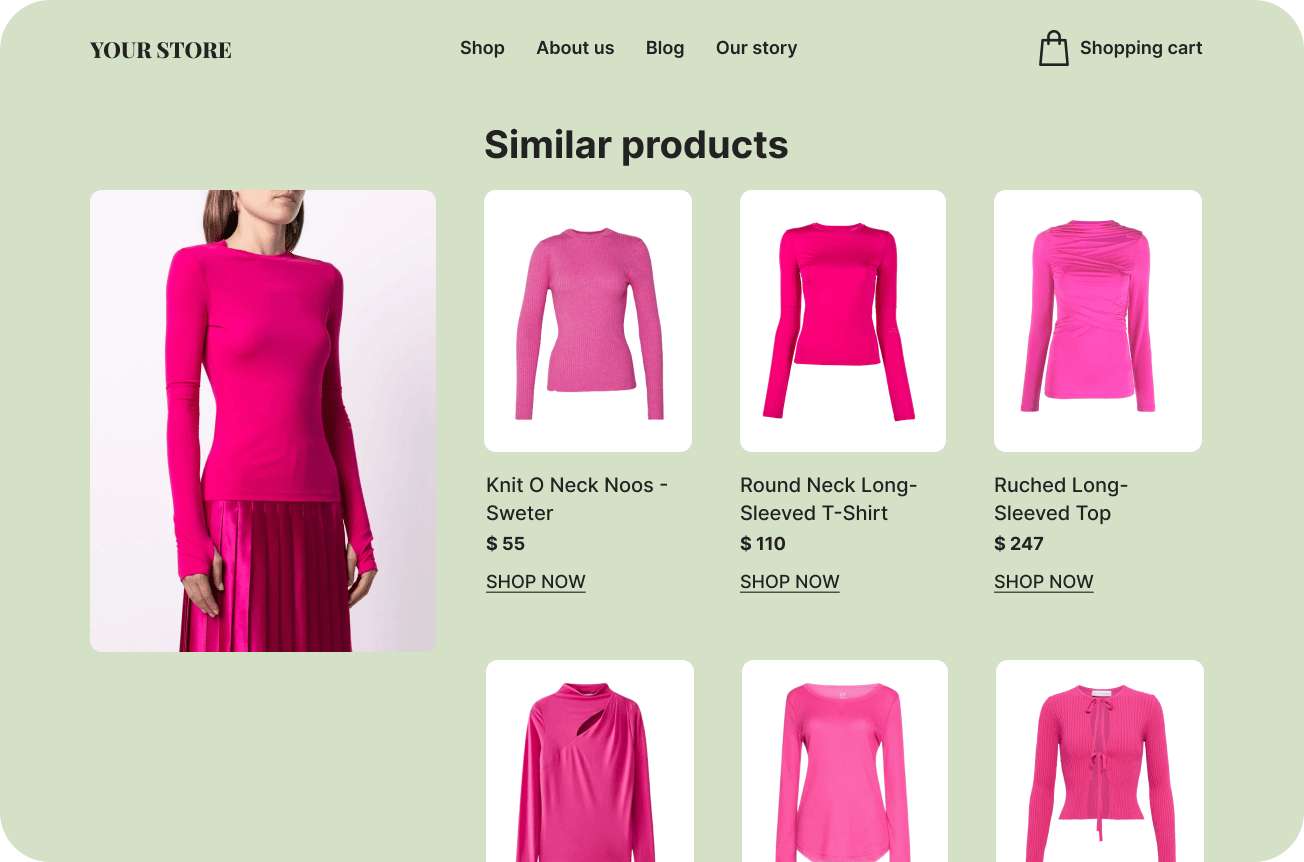

4. Data and Personalization

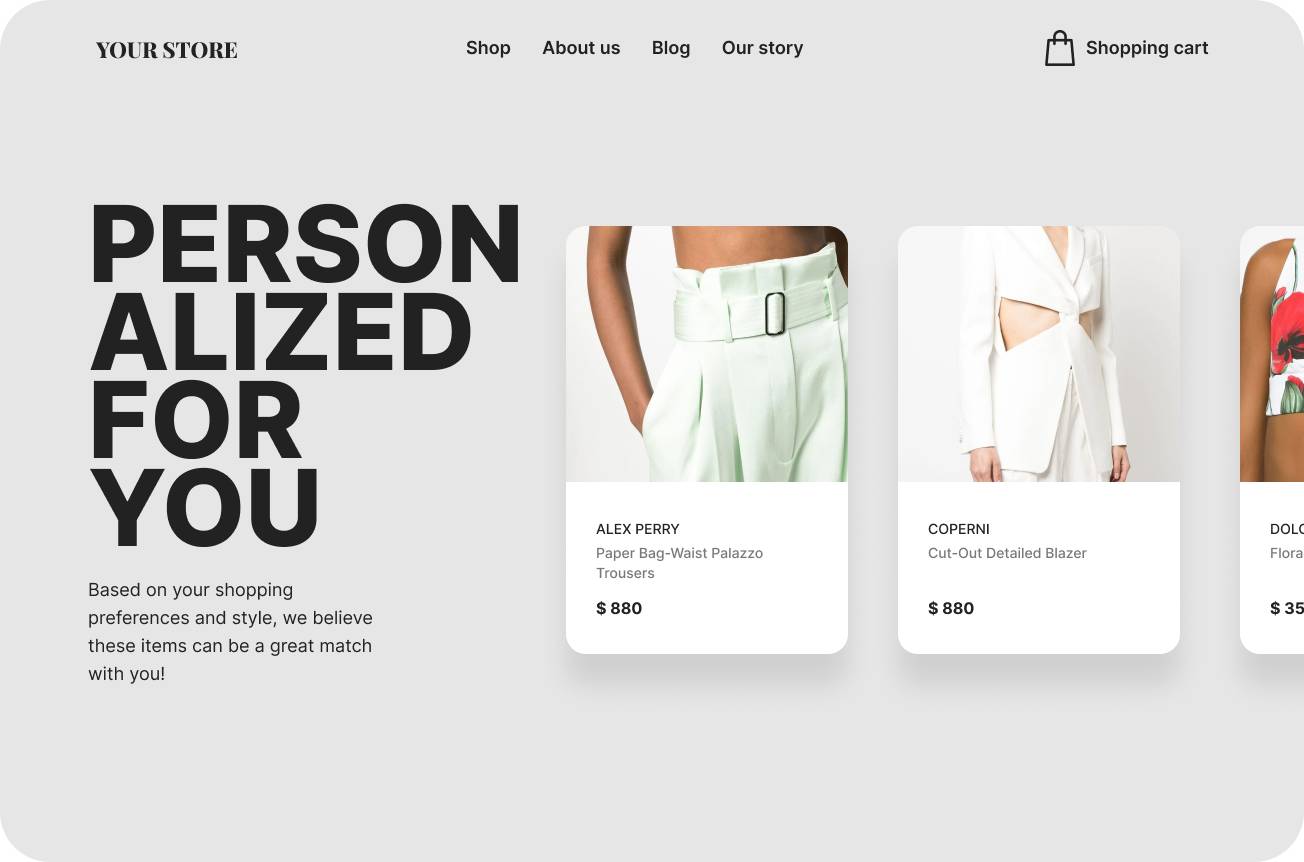

By matching the right customer with the appropriate product, data-informed decisions, personalized recommendations, and virtual fit, we all promise to boost sales and reduce returns.

Here are some deals of note:

- Wal-mart acquired Zeekit

- Snap acquired Fit Analytics

- Edited acquired DynamicAction

- Florida Funders backed XGen

- Zalando bought Fision

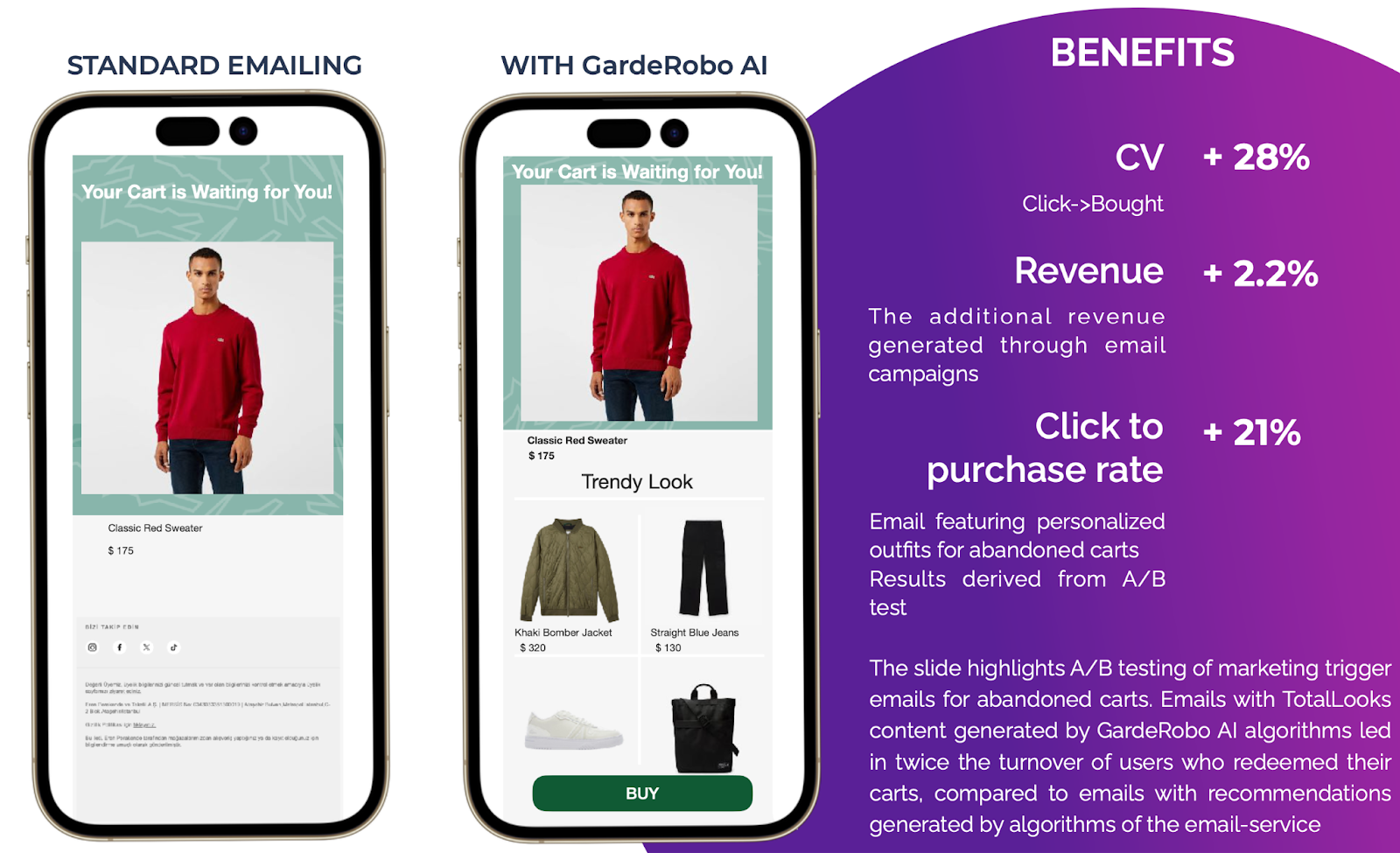

"As artificial intelligence and machine learning become mainstream, brands aim to create more personal relationships. Companies have been born out of that need," says Norwest's Beechuk, who has invested in Bluecore, an e-commerce personalization platform used by SEPHORA, Nike, and Tommy Hilfiger. "Rather than send the same email to millions of customers, Bluecore enables companies to send fewer individualized emails to a single customer," he says.

Personalization is crucial for addressing online fit issues. Consumers "want an inspiring and personalized digital experience", said Walmart US's Denise Incandela, EVP of apparel and private brands, in a report announcing the acquisition of fit-tech company Zeekit, which AZ Factory, Farfetch, and Bloomingdale's use. "Virtual try-on is a game-changer and solves what has historically been one of the most difficult things to replicate online: understanding fit and how an item will look on you. Consequently, startups have a unique opportunity to use their small company size to stay customer-centric for big retailers and rapidly react to the market's changes."

5. Sustainable Fashion

More than 80% of the carbon footprint produced by the fashion industry, according to a recent report from Quantis, is emitted during the manufacturing process; thus, businesses must rethink their sourcing practices to reduce the environmental impact of their garments.

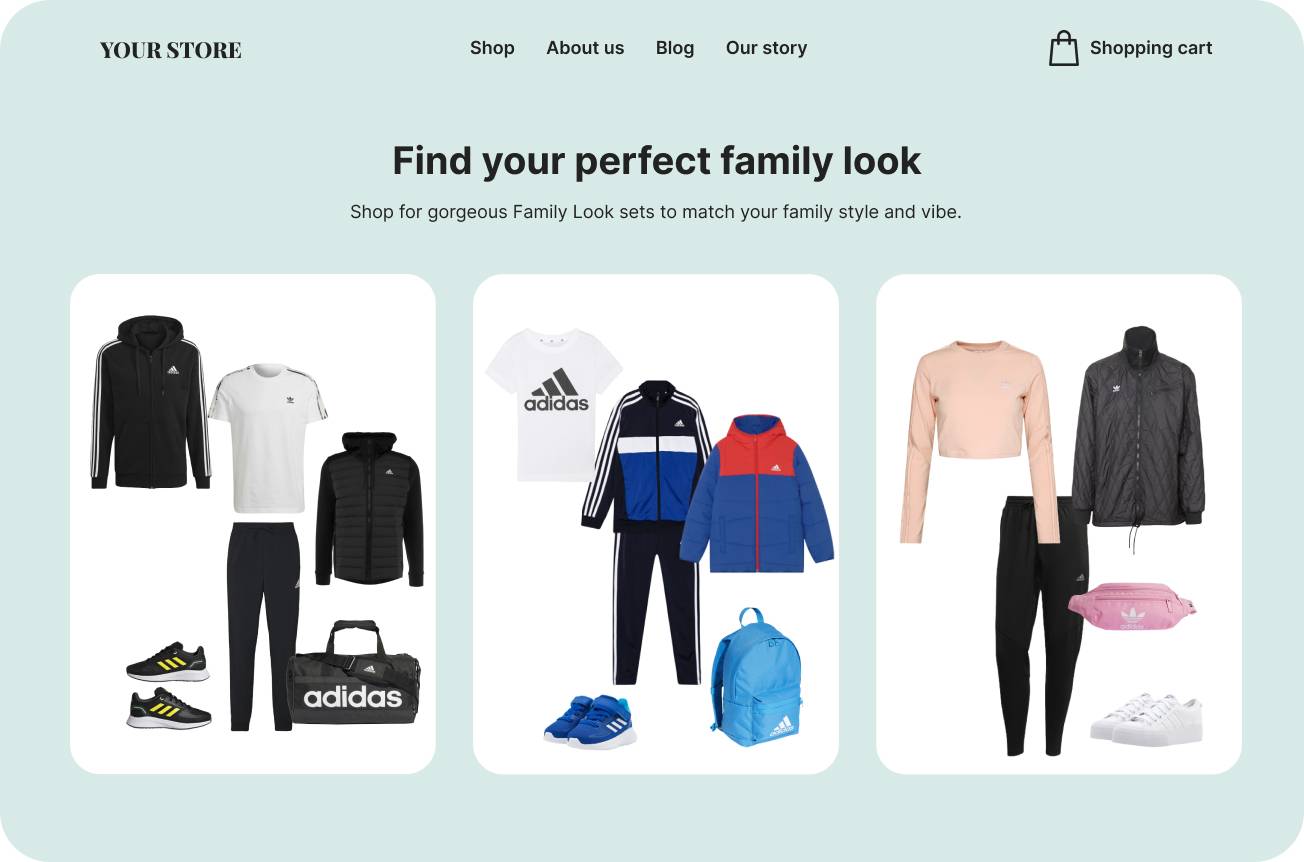

Garderobo uses advanced data analytics and machine learning to predict better sales, fashion trends, and consumer behavior and reduce the number of unsold clothes each season. Much research has been done to perfect this area because it's both environmentally friendly and cost-effective at the same time.

Consider GardeRobo A.I. : on average, our solutions help retailers reduce returns by 40%. Then there's the issue of overproduction. Relying on outdated and uncertain inventory models, it's estimated that fashion produces 30-40% more stock than it will sell. Offering inventory management tools that enable retailers to put less popular products in front of shoppers that are more likely to buy them, we're also doing our part to tackle the industry's struggles with waste. If you are eager to know more - let's have an e-coffee here:

Conclusion

To launch their companies, small to mid-sized fashion eCommerce startups continually seek VC-backed funding. Fashion e-commerce giants are investing more in digital services to improve all aspects of the in-person shopping experience.

Although venture capital funds, impact investors, and corporate investors are becoming more interested, the amount of money going into fashion startups still needs to be increased compared to the scope of the problem being tackled.

The development and commercialization of recycling technology, the emergence of leather substitutes, and the recent resurgence of legislative support for climate action in the US are all spurring increased interest in the sector. Supporting such initiatives is vital for businesses to secure their future.

However, flashy inventions need to address the sustainability issues in fashion. Additionally, attention must be paid to less glamorous and less lucrative issues like decarbonizing the industry's supply chain, boosting productivity, and slowing down fashion's consumption-driven growth engine.