Several persistent obstacles have garnered attention within the fashion industry and are poised to endure throughout the span of 2023-2024.

The fashion sector has gained renown for its substantial impact on the environment, encompassing factors such as carbon emissions, water consumption, chemical contamination, and the proliferation of waste. The task of upholding equitable compensation, secure labor environments, and morally principled treatment of workers across the worldwide supply network remains an ongoing and pressing endeavor.

Adopting sustainable methodologies, advocacy for transparency, and cultivating inventive approaches stand as imperative actions for propelling the fashion industry toward a future that is both ethical and environmentally conscientious. This post will delve into the foremost nine challenges confronting the fashion realm in 2023.

Sustainability

The United Nations reports that the fashion industry is one of the most ecologically harmful sectors, responsible for generating 8–10% of the planet's carbon emissions. Enterprises are faced with the imperative to transition towards employing recyclable, rejuvenative, and conscientiously sourced sustainable materials.

An investigation conducted by First Insight reveals that approximately two-thirds of global consumers are willing to pay a premium for sustainable products. This transformation in consumer behavior presents both challenges and prospects for clothing retailers, underscoring the necessity of adopting sustainable practices and offering environmentally-friendly design alternatives.

Several noteworthy trends in sustainable fashion warrant consideration by companies in 2023-2024:

- Enhanced Supply Chain Transparency: The year ahead will witness an ongoing consumer demand for heightened transparency regarding the origins of their clothing. Apparel vendors should accord significance to fair labor practices and secure working conditions.

- Quality Over Quantity: In 2023-2024, consumers will emphasize the quality of items rather than their quantity.

- Innovative Sustainable Materials: Brands ought to give precedence to materials that possess reduced environmental footprints, necessitate fewer resources, and alleviate dependence on conventional, resource-intensive textiles.

- Virtual Fitting Technologies: Virtual fitting rooms afford shoppers the opportunity to digitally test garments and ascertain the optimal fit without the necessity of physical donning. This diminishes the environmental ramifications stemming from multiple shipping and return cycles.

Supply Chain Challenges

Throughout the year, supply chain processes are expected to encounter disruptions due to an array of factors. These encompass persisting or emerging geopolitical tensions, inflationary influences, a deflationary landscape, climate change-induced extreme weather events, and unforeseen challenges yet to manifest. These factors collectively have the potential to impact the accessibility and transportation of products to their designated destinations. Furthermore, they might contribute to delays at ports, a reduction in container and ocean freight availability, and escalations in pricing, among other associated predicaments.

In the forthcoming year, the adept management of your business's reaction to these circumstances holds significant importance. Establishing three key constituents is imperative:

- Proficiency: Having the capability to systematically organize your supply chain, anticipate potential challenges, and capitalize on emerging prospects.

- Flexibility: Ensuring your supply chain is adaptable and nimble can prove instrumental in effectively addressing unforeseen contingencies, managing risks, and handling disruptions with efficacy and profitability.

- Comprehensive Visibility: Real-time communication with the array of partners within your supply chain network, obtaining a comprehensive overview of critical real-time indicators, and extending your supply chain beyond the confines of your company will likely emerge as essential endeavors. Achieving these objectives can be facilitated through the utilization of digital tools. The ultimate aim is to enhance collaboration across the entire spectrum of your supply chain ecosystem.

Resistance to technological adaptation

Amidst the prevailing trend towards embracing advanced technologies such as AI and Web3 within the fashion industry, a notable challenge emerges in the form of certain fashion retailers exhibiting resistance to technological adaptation. Despite the evident potential of these innovations to revolutionize various aspects of the industry, there persists a sense of apprehension and uncertainty among some retailers. This reluctance to engage in technological experimentation often stems from a combination of factors, including fears of potential disruption, concerns about the learning curve associated with implementing new systems, and the anxiety of departing from established methods.

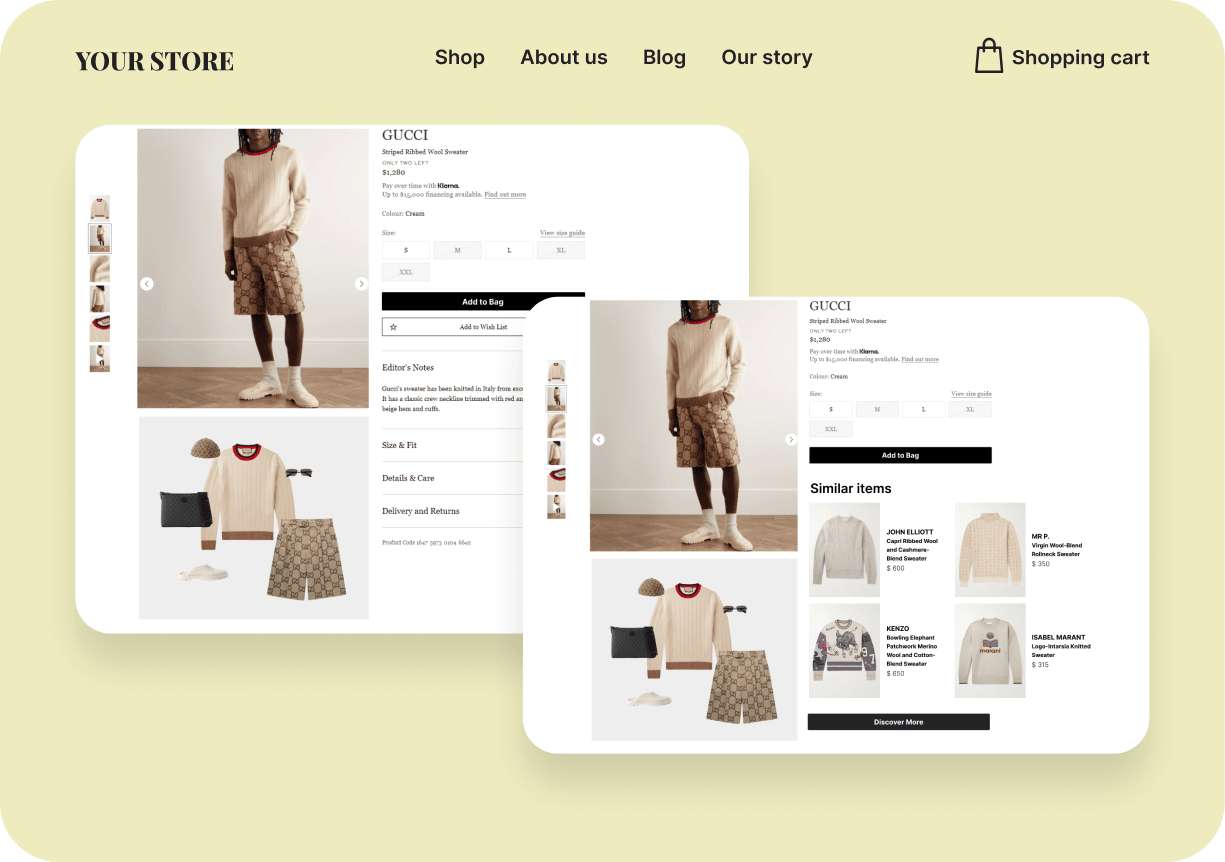

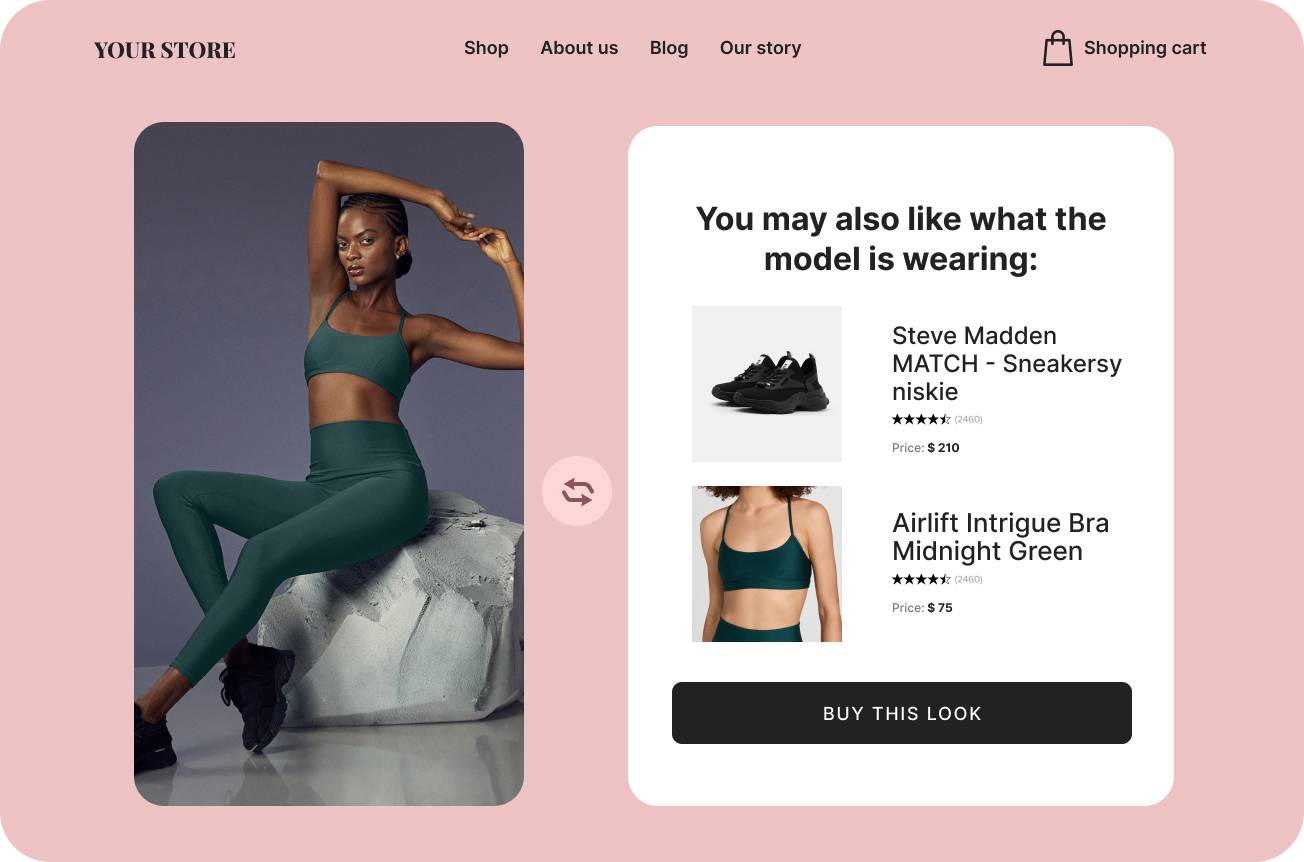

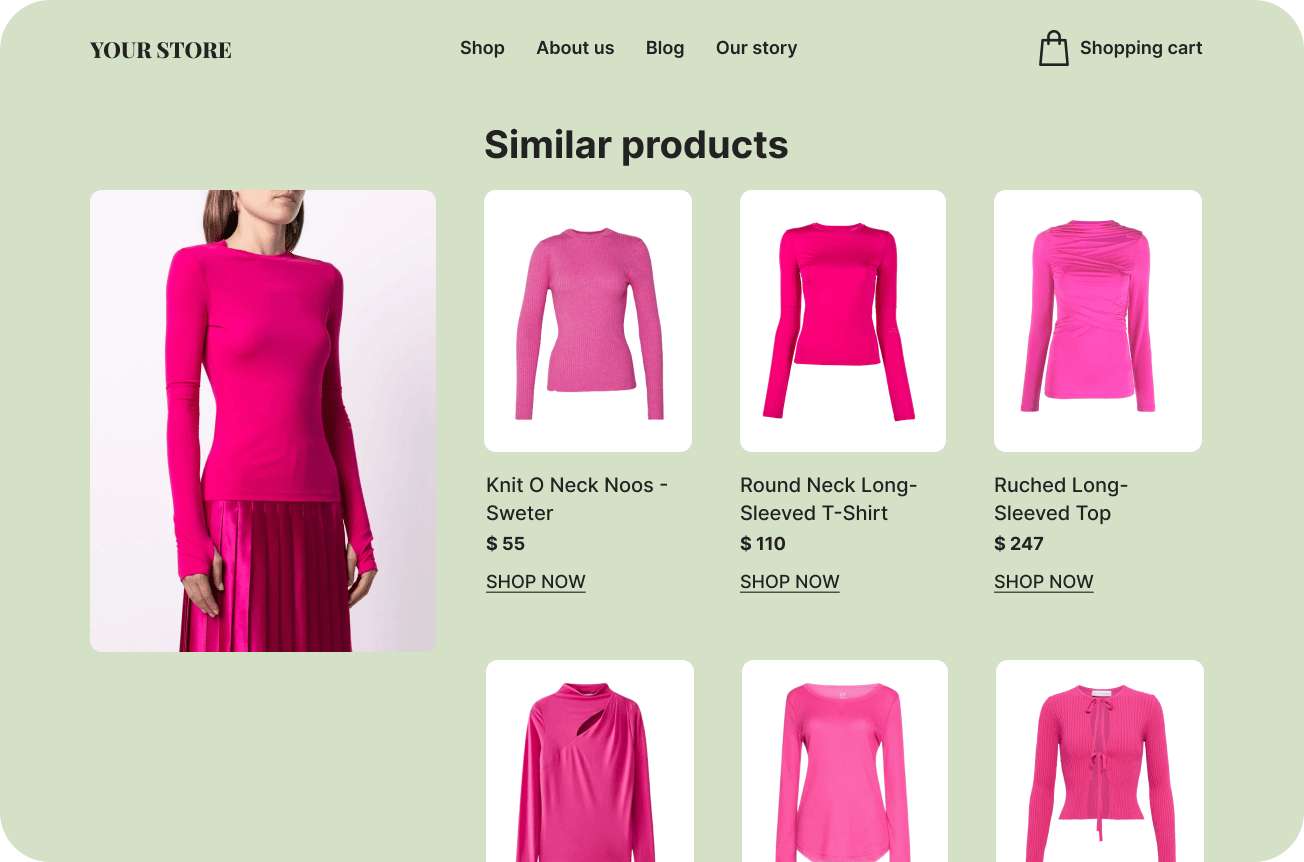

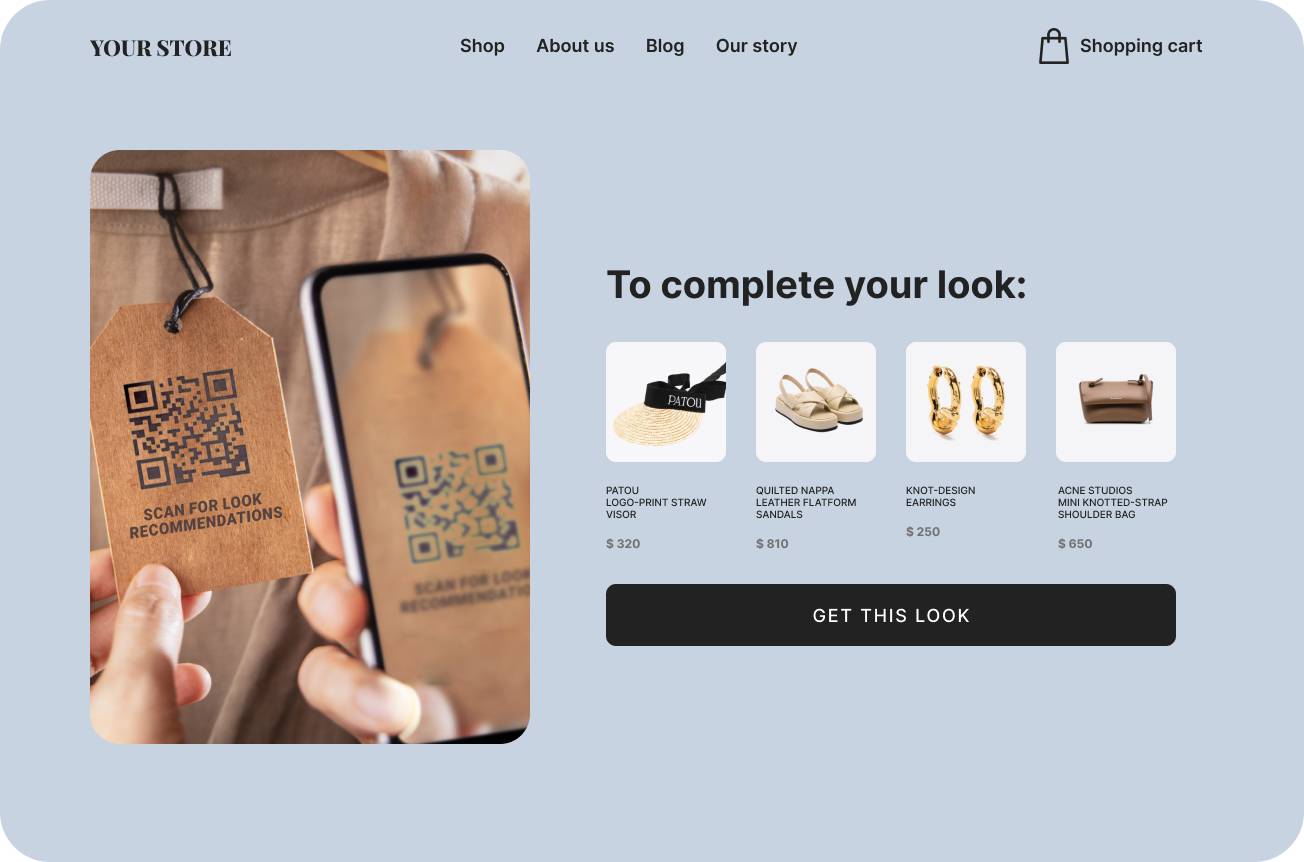

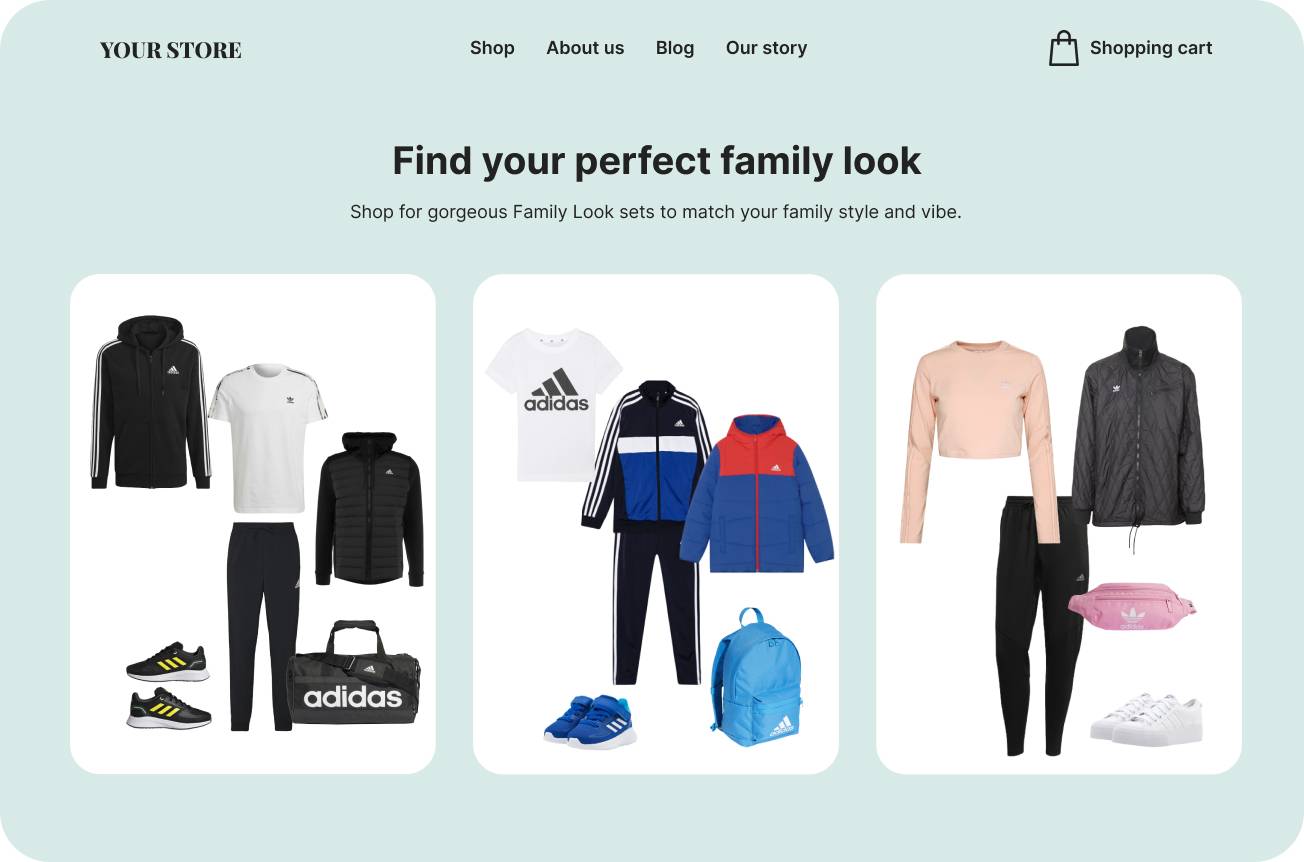

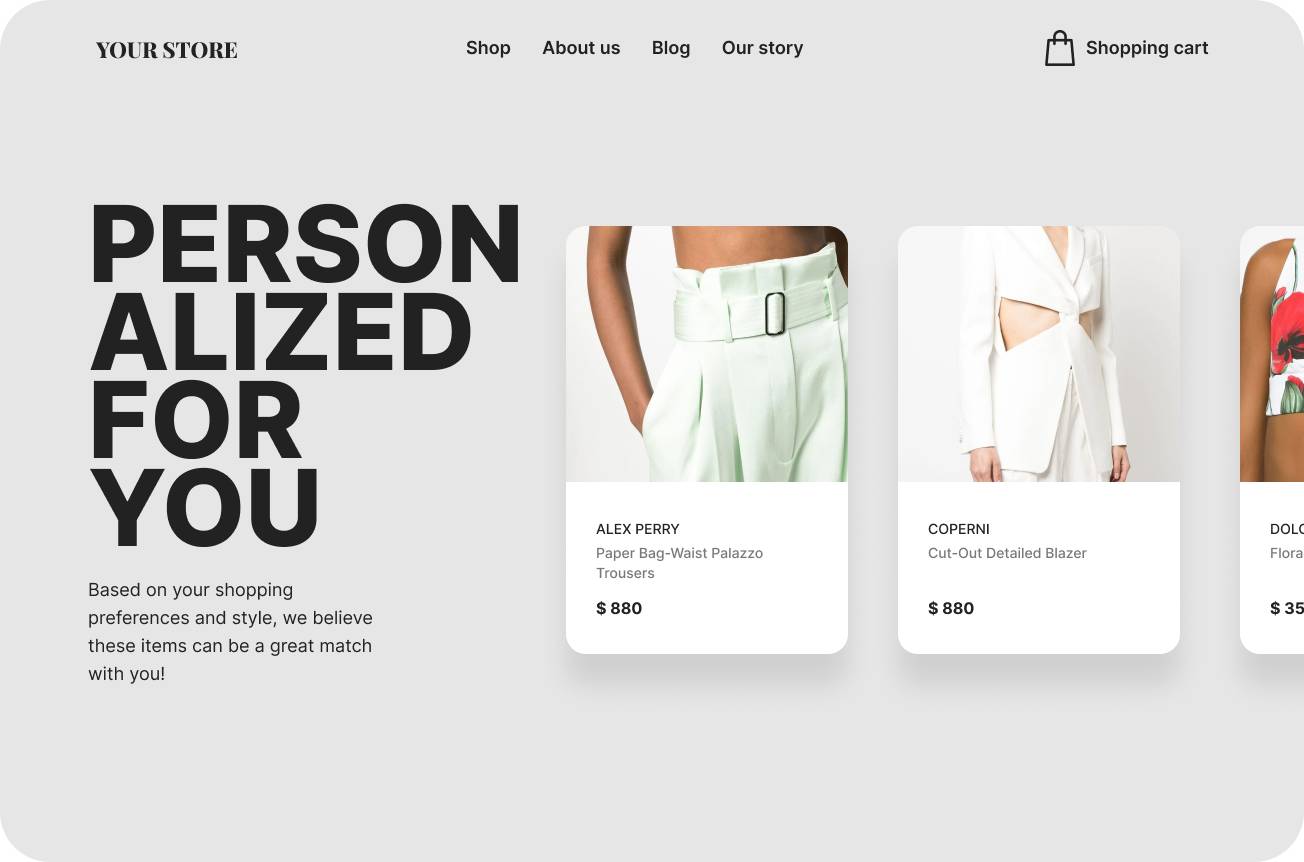

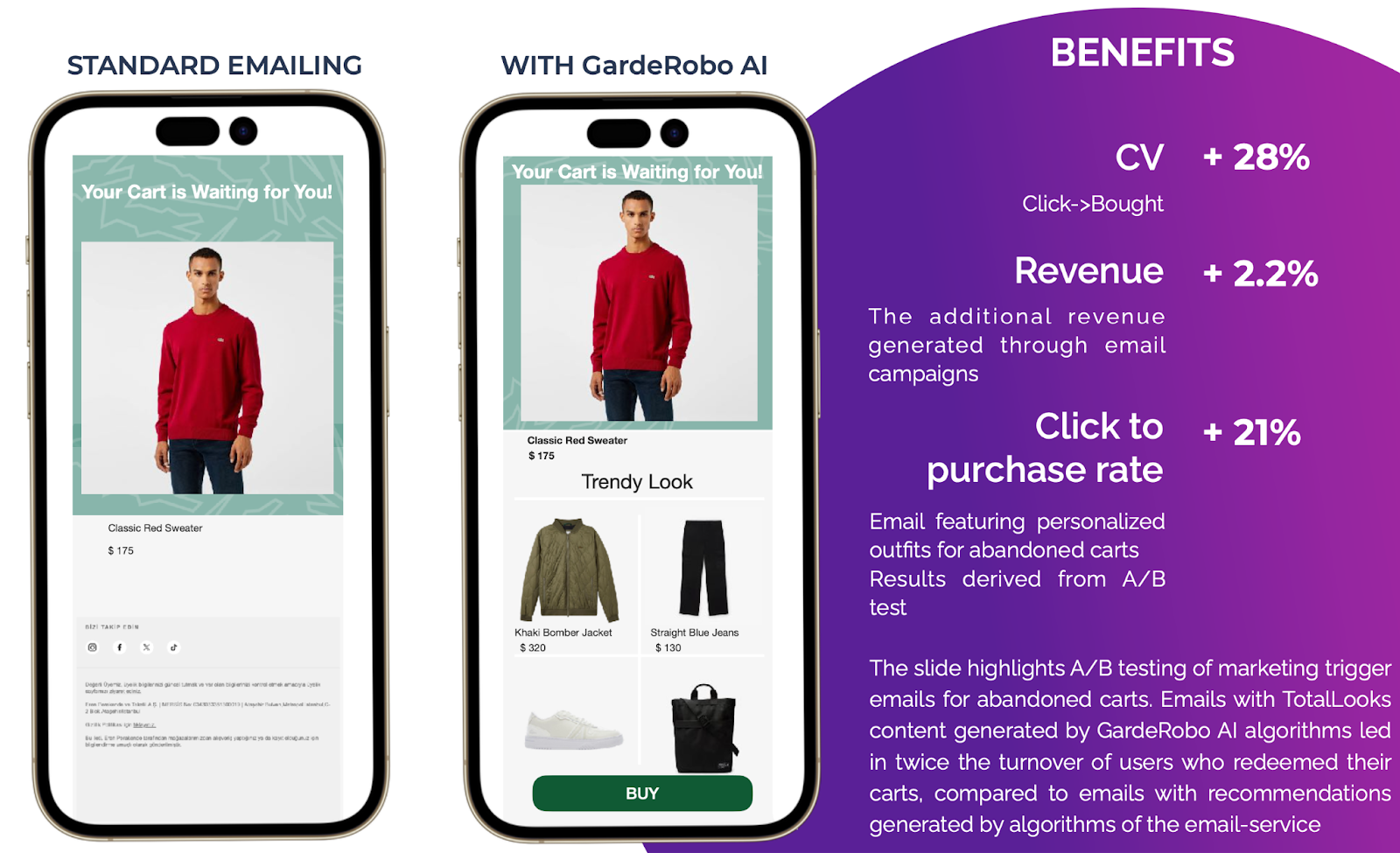

However, amidst this landscape, solutions like GardeRobo AI offer a promising avenue for fashion retailers to navigate this challenge. GardeRobo AI, an AI-powered stylist tailored for product pages and in-store experiences, offers a means to personalize the fashion shopping journey and create engaging and aesthetic product recommendations. This tool promises simplicity, requiring only 48 hours for implementation and offering comprehensive support from our side. It's an opportunity for retailers to leverage technology without trepidation, ultimately enhancing customer experiences and refining their operations. As the industry continues to evolve in the face of technological advancements, embracing AI-powered solutions like GardeRobo AI can pave the way for fashion retailers to remain competitive and resonate with the ever-changing preferences of their clientele. Learn more here.

Fit Challenges and Evolving Consumer Preferences

Challenges related to fit and evolving style preferences stand out as prominent contributors to elevated return rates. Current surveys underscore the increasing preference for gender-fluid fashion and gender-neutral fit among consumers. In order to maintain relevance, fashion enterprises must adapt and make necessary modifications to cater to this evolving clientele.

The surge in return rates is a notable trend, with the National Retail Federation indicating an average return rate of 20.8%, marking a substantial 96% surge since 2020. Ill-fitting garments or mismatched styles contribute to a substantial 70% of all returns. PwC's projections suggest that the range of online fashion purchases returned ranges from 30% to 40%.

To tackle this concern, fashion designers can leverage 3D technology to promptly identify fit issues prior to manufacturing physical samples. Additionally, avoiding miscommunication with manufacturers can prove pivotal in ensuring an optimal fit.

Shifting Consumer Preferences

The resurgence of the industry is projected to be driven by Millennial and Generation Z consumers, who hold fashion among their top three expenditure preferences.

However, captivating these customers will necessitate a strong commitment to innovation. According to Context Consulting, a considerable 50% of consumers express a preference for enhanced technological integration in retail over more competitive pricing.

As enthusiasm for fashion NFTs and virtual realms continues to grow, leading enterprises are beginning to explore avenues like blockchain and digital fashion. Recognizing that 71% of consumers desire augmented reality integration within their purchasing journey, retailers must factor this into their strategies as well.

The ascent of gender-fluid attire mirrors evolving consumer perspectives on gender identity and expression. The blurring lines between traditional menswear and womenswear demand a comprehensive reevaluation of product design, marketing strategies, and both in-store and online shopping experiences for numerous businesses and retailers.

Resilience Against Cyber Attacks

As per IBM's findings, the retail sector ranks as the fourth most targeted industry, with the average breach incurring a cost of $3.28 million. The potential loss of customers' trust could escalate these expenses significantly.

Brands must adopt proactive cyber risk management strategies across the entire value chain. This involves careful consideration of how data is managed, from its collection phase to utilization and eventual disposal.

When utilizing a Product Lifecycle Management system for fashion product creation, safeguarding design data is paramount. Evaluating the security standards adhered to by the new system is essential. Furthermore, ensuring access to work files from any location, at any time, is crucial. An effective PLM system should incorporate features like data backup and recovery, as well as data encryption, to ensure security.

Inflation and Fluctuating Raw Material Prices

The discernible impact on the global economy is evident, with the growth rate of 6.1 percent reported in 2021 projected to decline to approximately 3 percent in 2022 and around 2.5 percent in 2023. This outlook is characterized by significant uncertainty, reflective of the ongoing instability within the global economy.

In response to inflation and macroeconomic instability, the market is poised to diverge. While the affluent class is likely to continue its spending habits relatively unscathed, the broader population is anticipated to not only curtail expenditures but also contribute to a surge in the secondhand market, outlets, and discounted offerings. Consequently, the primary luxury market might experience a decline.

Meanwhile, the challenges related to transportation and raw material costs persist within the industry. The Harpex index, which gauges the expense of container ship charters, still rests approximately 100% higher than its January 2020 benchmark.

Lack of Skilled Workforce

The ongoing struggle to secure skilled personnel, a challenge spanning several years, will persist as a key issue in the forthcoming year.

To attract talent, the garment sector should consider raising minimum wages, eliminating unpaid internships, and fostering diversity in hiring. Notably, LVMH's commitment to educate 25,000 individuals from diverse backgrounds through internships, apprenticeships, and permanent positions exemplifies such efforts.

Time-to-Market

Time-to-market signifies the speed at which a fashion product progresses from concept to availability for purchase.

The creation of a new fashion item involves a series of stages encompassing design, prototyping, sampling, and testing. Each of these steps demands time and coordination among various teams, including designers, pattern makers, and manufacturers. Delays or inefficiencies at any stage can influence the overall time-to-market, underscoring its significance.